Easy Integration Options

Advantages of E-Filing Form 1099 NEC with Us

Supports Federal and State Filing

We Postal Mail your

recipient copies

Secure Online Access

for Recipients

In-built Error Check to ensure error-free transmission

Validate recipient TIN with our TIN Matching program

USPS Address Validation to ensure that you have entered the right address

View or Download Forms from our Print Center Directly

Option to request recipient TIN using Form W-9

Get access to all these Features Right Now

When is the Form 1099 NEC due date?

Whether you file on paper or electronically, Form 1099-NEC must be filed by January 31. By the same date, filers must also furnish a copy of Form 1099-NEC to their recipients. If the deadline falls on a weekend or federal holiday, the next business day becomes the filing deadline.

Some states require payers to file 1099 forms, and deadline for 1099-NEC state may vary. Refer to the Form 1099-NEC state filing requirements and the complete 1099 deadline 2026 for full details.

E-file your Form 1099-NEC before the deadline and stay away from the Penalties.

How to E-file Form 1099 NEC?

Form 1099 NEC electronic filing is quick, simple, and secure. Just follow the steps below to complete and efile your 1099-NEC in just a few minutes:

Select “Form 1099-NEC” from the dashboard.

Enter the required details

Review the Form information.

Transmit your 1099-NEC to the IRS and State.

Distribute Recipient Copies (Postal Mail / Online Access).

Once you Efile, you can have us deliver your recipient copies. We provide you an option to deliver recipient copies via postal mail and secure online access.

Click here to know How to fill out Form 1099-NEC

Get Started Today and E-file your Form 1099 NEC in a few minutes!

Form 1099 E-File Pricing

| No. of Forms (Price per-form) | 1-10 Forms | 11-100 Forms | 101-250 Forms | 251-500 Forms | 501-2000 Forms | 2000+ Forms |

|---|---|---|---|---|---|---|

| 1099 Federal E-File | $2.75 | $1.75 | $1.15 | $1.00 | $0.80 |

Contact us for

Bulk Pricing

704.684.4751 Request Quote |

| 1099 State E-File | $0.95 | $0.95 | $0.95 | $0.95 | $0.95 | |

| Postal Mail | $1.85 | $1.85 | $1.85 | $1.85 | $1.85 | |

| Online Retrieval | $0.50 | $0.50 | $0.50 | $0.50 | $0.50 | |

| TIN Matching | $0.35/TIN | |||||

Click here to know more about 1099 E-file pricing

Customer Reviews

Frequently Asked Questions on

Form 1099-NEC

Electronic Filing

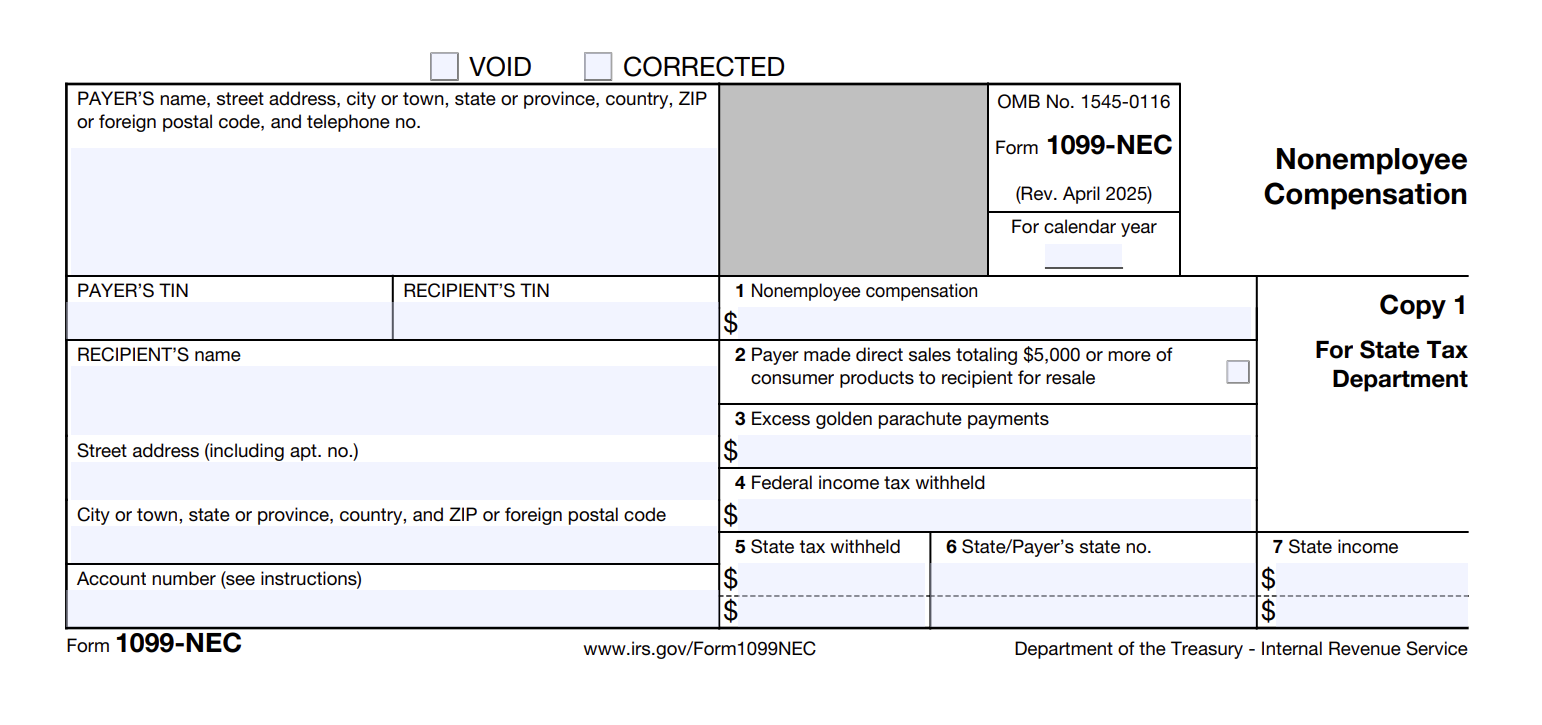

- What is Form 1099-NEC?

- What information is reported on Form 1099-NEC?

- How do I file 1099-NEC with the State using TaxBandits?

- Is there a Bulk upload option for form 1099-NEC with TaxBandits?

- What is the difference between Form 1099-K vs 1099-NEC vs 1099-MISC?

- What Forms 1099 are required for landlords, tenants, and property managers?

Other Supported Forms

- Form 1099-MISC, Form 1099-K, INT, DIV, R, S, G, C, B, PATR & other 1099 Form

- Form 1095-B/C, 941-PR, 941-SS

- Form W2, W-2c, W-2PR, W-3

- Form 941, 941-PR, 941-SS

- Form 990-N, 990-EZ, 990, 990-PF & 1120-POL

- Form 8868, Form 8809

Fill out & share your W-9 online

TaxBandits’ Fillable W-9 solution allows users to quickly complete and e-sign the W-9 form in minutes, Our system performs basic data validations to ensure accuracy and error-free completion. W-9s are securely stored, allowing users to access, edit, or share them anytime.

Form W-9: Request for Taxpayer Identification Number and Certification

Invite your vendors to complete and e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to e-file the 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form.

With TaxBandits online portal, employers can request w9 form online and manage all W-9 forms at one place securely. Sign up now and request the Form W-9 for FREE.

Request W-9 Now

Integrate TaxBandits API for Streamlined 1099 Automation within

your Software!

1099 Automation simplifies the preparation and e-filing of 1099 Forms at the end of the year with the following steps:

- Obtaining W-9 forms from vendors/gig workers/affiliates

- Keeping track of all payout transactions done throughout the year

- The 1099 forms will be prepared and e-filed with the IRS and the state based on the W-9 data and payouts.

- The beneficiaries will receive the 1099 copies by postal mail or online access.